So simply getting people talking regularly or sharing data in a weekly stand-up is a great starting point. Instead, it may be initially more appropriate to take smaller and more actionable steps.ĭistinct financial crime teams have spent years focussing on their metrics and deliverables. Attempting to integrate these systems might be a long-term North Star to aim for. However, consider how entrenched these siloes may be within large banks. A single operations centre may work for some. This can then be complemented with processes and teaming models that enhance collaboration between case workers. The ultimate vision is to have a single, secure data platform that brings together all data from across a bank to help support risk decisions in real time. Unlock the value of data by reducing siloes

While there are certainly benefits to doing so, overcoming these existing silos in a large complex organisation is no mean feat.

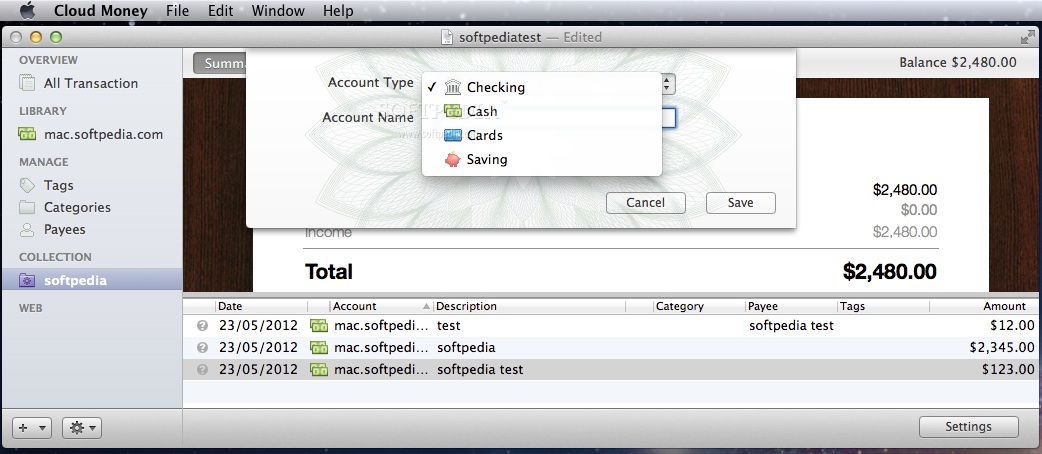

CLOUD MONEY LAUNDERING HOW TO

More organisations are considering how to optimise their teams, processes and tools to improve detection insights and reduce rework. This is exactly the shift we are seeing today. With this in mind, it makes sense to think about financial crime in a more holistic fashion. Up to 30 percent of money laundering activity may involve fraud as well – and a portion of that could also be linked to cybercrime. Multiple teams, systems and solutions are applied to detect anomalous behaviour and there is often overlap in these efforts.

This is only expanding as regulations become more extensive and watchlists continue to grow. However, increasing attention is being paid to cyber risks and fraud, with more emphasis on the overall effectiveness of a bank’s approach rather than just adhering to rules.įor larger banks, there is already significant effort required to consolidate data, profile customers and transactions and to detect and investigate threats. AML-KYC has been the primary focus for financial regulators.

0 kommentar(er)

0 kommentar(er)